本文

Fixed Asset Tax (Koteishisanzei) / 固定資産税

毎年 1月1日に 次のものを 持っている人が 払います

- 土地

- 家や アパート、マンション、ビル、店など、建物

- 機械、道具、船、ヘリコプターなど、仕事に 使うもの

固定資産税の 払い方

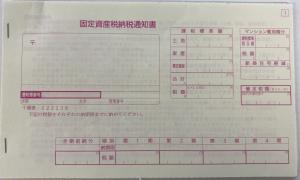

固定資産税納税通知書

4月に ピンクの字で 書いてある書類が、あなたに 郵便で 届きます。

- 税額〈いくら 払うか〉

- 納期限〈いつまでに 払うか〉が 書いてあります。

※払ったあと、領収書に なります。絶対に 捨てないでください。

払うとき、届いた書類を 持っていきます

▶Places you can pay taxes / 税金を 払うところ

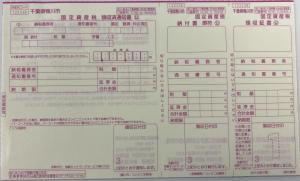

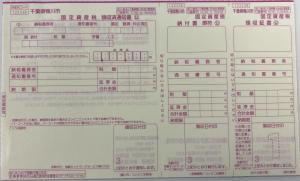

固定資産税 領収済通知書の 右の 番号が 小さい 紙から 使います。

※ぜんぶ 払う人は、「全」と 書いてある紙を 使ってください。

| 1回ずつ 払います | ぜんぶ 払います |

|---|---|

|

|

納期限を 見てください

納期限を 過ぎてから 払うと、もっと お金を 払わなければ なりません。納期限までに 絶対に 払ってください。

払えないとき、納期限が 来る前に 税務課に 相談してください。(電話 04-7093-7832)

問い合わせ

税務課

電話 04-7093-7832

People who must pay Fixed Asset Taxes (kokuteishizei):

If, as of January 1st, you have owned or bought any of the follwing:

- Land: rice fields, farm fields, residential land, mountain/forest area, pond/lake, farms, wild fields, etc.

- Personal buildings: Houses, shops, factories, storage, offices, etc.

- Depreciable property: Land or other facilities for commercial use, tools, machinery, etc

...you will have to pay fixed asset taxes to the city.

Note - the following properties are exempt from taxes:

- Land with a value of less than 300,000yen

- Personal buildings with a value of less than 200,000yen

- Depreciable property with a value of less than 1,500,000yen

How to pay fixed asset taxes:

Payment Notice Slip for Fixed Asset Taxes

A payment slip printed with pink ink will be sent to you in the mail during the month of April. An example is pictured here.

You will find the following written on the slip:

- 税額 (zeigaku) - the amount of taxes you owe

- 納期限 (nokigen) - the deadline you have to pay by

※This slip will act as a receipt of your payment after any tax payments are made. Do not throw away or lose this slip.

You must bring this slip when making payments.

▶Places you can pay taxes / 税金を 払うところ

If you make your tax payments in installments, please follow the numerical order (starting at number 1) that are written in the upper right hand corner of the slip.

※If you plan to make your payments all at one time please use the sheet marked 「全」(zen).

| Example of installments slip | Example of full payment slip |

|---|---|

|

|

Always check and follow the payment deadlines! (納期限, nokigen )

If you miss the payment deadline written on this slip you will have to pay an extra late fee. Please always confirm that you are paying the correct installment by this timeline.

If you are unable to make a payment for any reason, contact the Tax Division (04-7093-7832) before your payment is due.

Tax Calculation

Taxes are calculated using the following formula:

Taxable value (of land, houses, depreciable property) × tax rate (1.4/100) = Fixed asset tax

Questions: Tax Division (04-7093-7851)